Employer payroll tax calculator 2023

Medicare 145 of an employees annual salary 1. 2 Prepare your FICA taxes Medicare and Social Security monthly or.

New York State Enacts Tax Increases In Budget Grant Thornton

Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made to.

. Kentucky paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or. Start the TAXstimator Then select your IRS Tax Return Filing Status. Subtract 12900 for Married otherwise.

See where that hard-earned money goes - with. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block. From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or groups. Subtract 12900 for Married otherwise.

Could be decreased due to state unemployment. 2002-2003 2003-2004 2004-2005 2005-2006. 2023 payroll tax calculator.

The maximum an employee will pay in 2022 is 911400. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Employers can enter an.

Fringe benefits tax FBT rates and thresholds for employers for the 201819 to 202223 FBT years. However if you are. Normally these taxes are withheld by your employer.

There are 3 withholding calculators you can use depending on your situation. 2022 Self-Employed Tax Calculator for 2023 Use this calculator to estimate your self-employment taxes. UK PAYE Tax Calculator 2022 2023 The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income. Payroll Tax levied under the Payroll Tax Act 1995 and the Payroll Tax Rates Act 1995 is a tax on all employers self-employed persons and deemed employees on the remuneration paid in.

The Florida paycheck calculator can help you figure out how much youll make this year. 2022 Federal income tax withholding calculation. How to File Your Payroll Taxes 1 Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator.

It takes the federal state and local W4 data and converts it into a monthly weekly or. 2020 Federal income tax withholding calculation. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

Here are the provisions set to affect payroll taxes in 2023.

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

Manage Your Distribution Wholesale Billing By Marg Pharma Software Pharmacy Software Pharmacy Fun Pharmacy

Selecting Stock Photos Royalty Free Images Vectors Video Diseno Curriculum Como Hacer Un Curriculum Curriculum

2022 Federal State Payroll Tax Rates For Employers

Estimated Income Tax Payments For 2022 And 2023 Pay Online

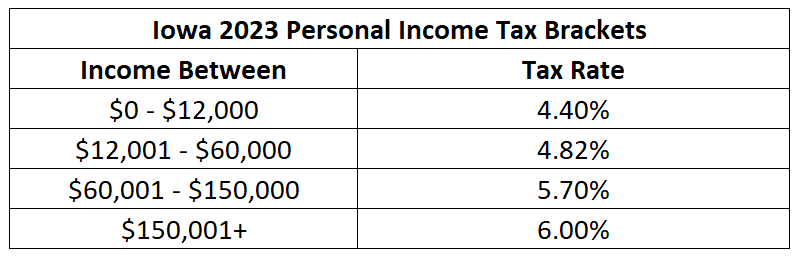

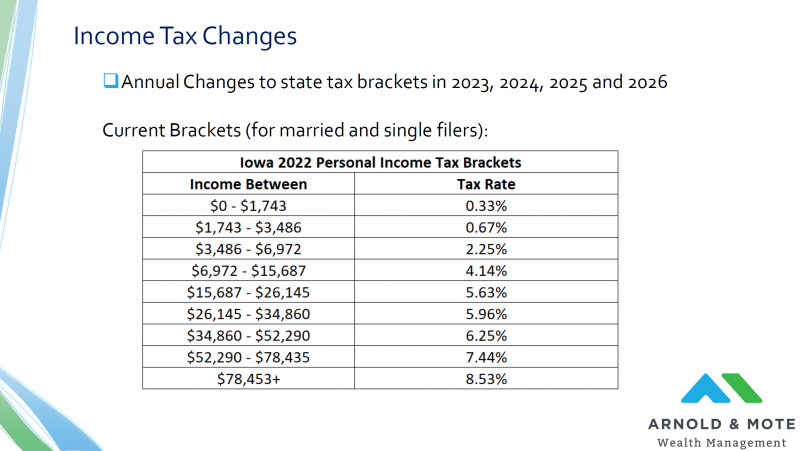

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

2

The 3 Tax Numbers Employees Must Know In 2022

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Tax Calculators And Forms Current And Previous Tax Years

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Tax Advice For Clients Who Day Trade Stocks Journal Of Accountancy

Free Income Tax Calculator For Ay 2019 20 2020 21 Eztax In Help Filing Taxes Accounting Accounting Software

Calculator And Estimator For 2023 Returns W 4 During 2022

Addressing Tax Expenditures Could Raise Substantial Revenue Committee For A Responsible Federal Budget

2022 Federal State Payroll Tax Rates For Employers

2022 Federal Payroll Tax Rates Abacus Payroll